2025 Real Estate Market Forecast

The Toronto Real Estate Market in 2024

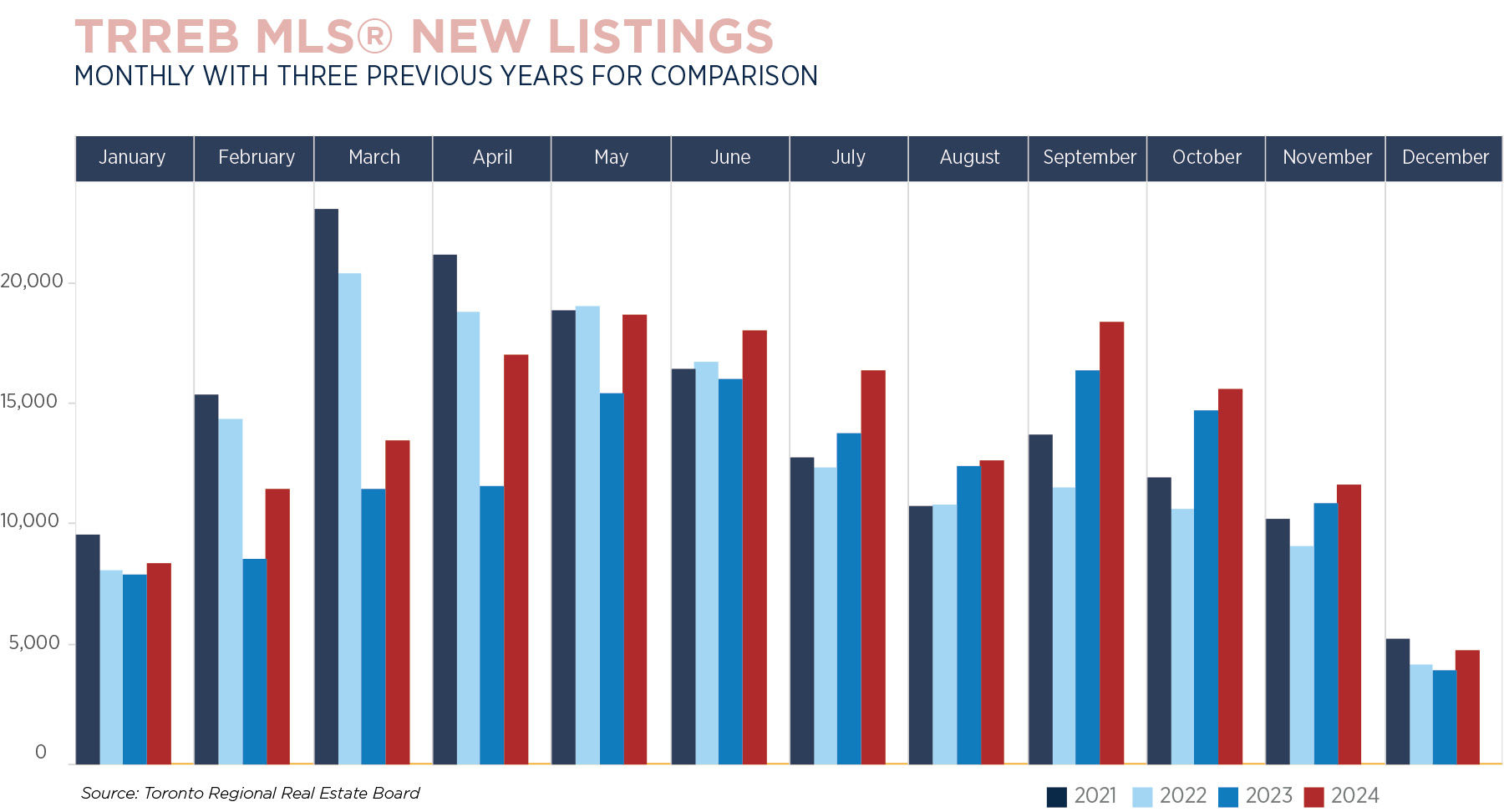

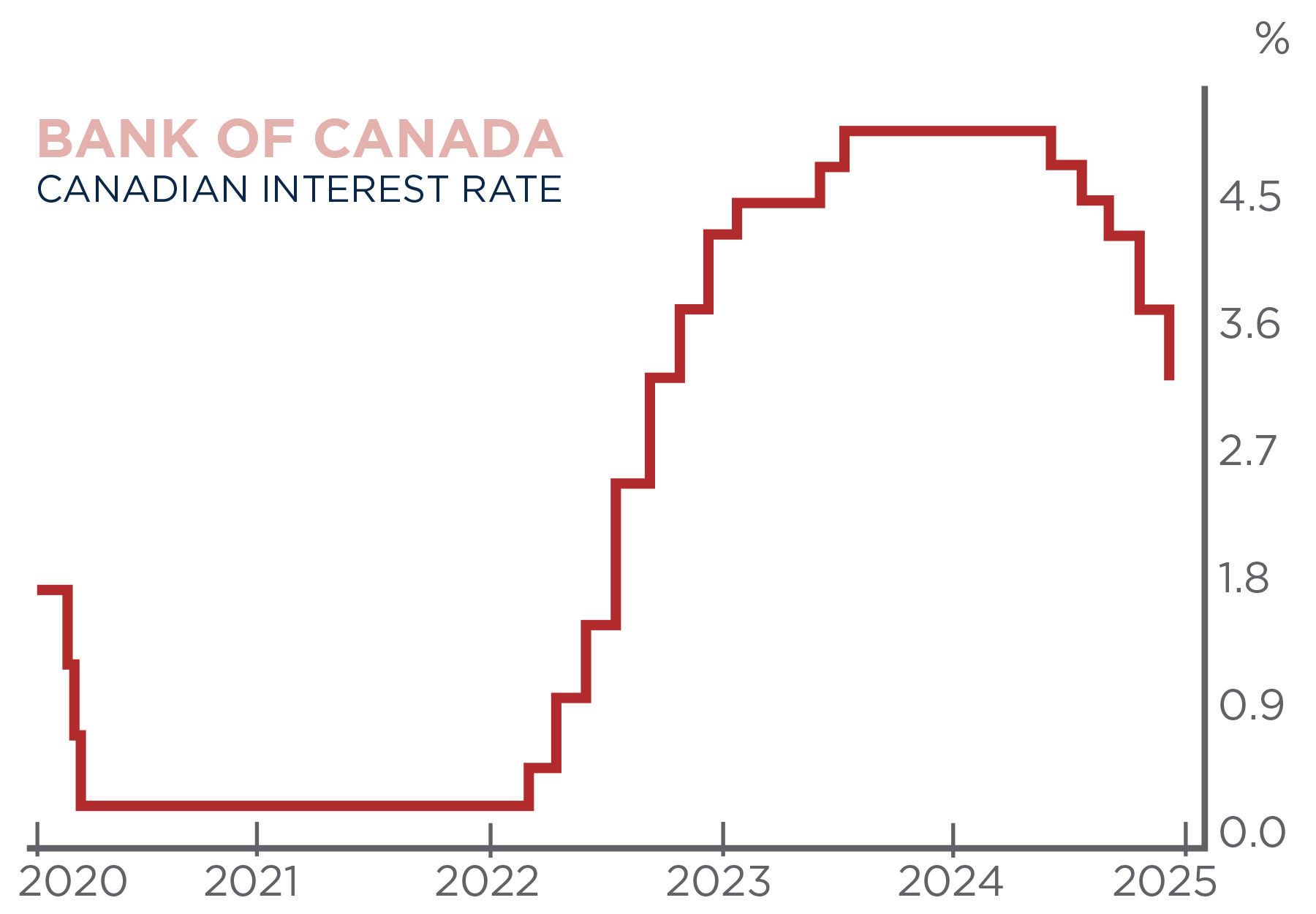

The Toronto real estate market in 2024 was significantly influenced by high borrowing costs, which remained a substantial hurdle, stifling affordability and keeping many potential buyers—especially first-time buyers—out of the market. Despite this, a year-over-year increase of 16.4% in new listings provided buyers with greater choice, effectively preventing price growth across all segments.

Although activity throughout the year was modest, a shift in buyer sentiment emerged late in the year, following back-to-back 50-basis-point interest rate cuts. These reductions slightly improved market conditions.

As a result, the Greater Toronto Area recorded 67,610 home sales in 2024, representing only a 2.6% increase from the previous year, and sales remained well below historical norms. Among market segments, single-family homes, including detached and semi-detached properties, performed better, with values stabilizing. In contrast, high-rise condo apartments experienced more pronounced price declines, and pre-construction starts and sales stalled significantly in 2024.

2025 Forecast

Real Estate Market segments are expected to rebound at varying timelines in 2025. Policy changes, such as extended amortization periods and allowing buyers to finance properties up to $1.5 million with less than 20% down, combined with anticipated further declines in interest rates, will continue to improve buyer sentiment and stimulate market activity.

Low-Rise and Single-Family Homes

Sales of low-rise, single-family homes, including detached and semi-detached properties, are expected to see the most activity and price growth in 2025. While some forecasts predict relatively flat home prices, we believe values in this segment will rise significantly, potentially pricing out buyers sooner than anticipated. Buyers will likely realize that their window of opportunity within the freehold and low-rise market is narrowing rapidly.

Condo Market

The resale condo market, which faced significant challenges in 2024 due to high investor ownership, is poised to benefit. Higher inventory levels will begin to be absorbed by first-time buyers who can no longer afford low-rise homes. As a result, condo sales are expected to outpace new listings throughout the year.

Pre-Construction Segment

The pre-construction market will take more time to recover. Currently, the cost of acquiring pre-construction units far exceeds the resale market, and builders are unable to lower prices due to high construction costs. Developers will likely focus on selling off existing inventory before launching new projects. The best opportunities in 2025 may lie in the assignment market, where original buyers unable to close may sell units below current market values. However, as interest rates continue to decline, this opportunity may not last long.

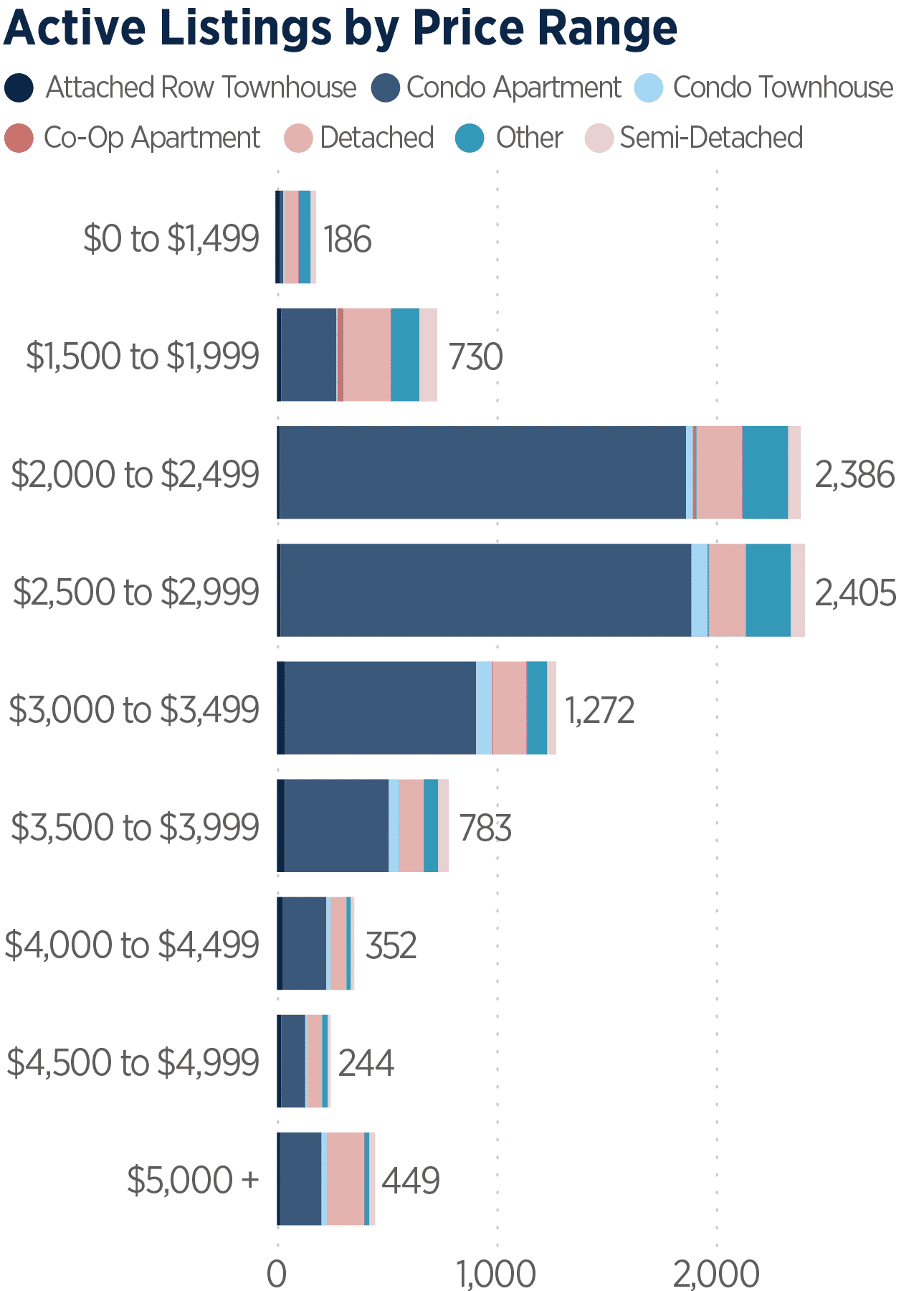

Rental Market in 2025

Relief for renters may be on the horizon, albeit at the expense of future real estate supply. High construction costs and municipal development fees have led many developers to shift planned condo projects toward purpose-built rentals. Over 70% of planned condo developments are now being reallocated to rental properties.

Inventory in the rental market will remain elevated at 1.5-2 months of supply, compared to the 10-year average of 0.9 months. This will continue to provide renters with more options and force some landlords to adjust rental rates to stay competitive and even keep current tenants.

Summary

Projected interest rate reductions in 2025 are expected to enhance affordability and stimulate the real estate market. While impacts will vary across segments, the underperformance of sales—falling below 70,000 annually for two consecutive years—highlights the number of buyers and sellers who have remained on the sidelines. This pent-up demand, coupled with improving market conditions, is likely to create significant momentum, leading to a very active marketplace in 2025.