Toronto Real Estate Market Report-November

The Toronto Regional Real Estate Board (TRREB) reported a 44.4% increase in home sales year-over-year, with 6,658 transactions. This surge is attributed to recent interest rate cuts and the expectation that the Bank of Canada will continue reducing rates in the coming months. Another rate cut of 0.50 basis points is highly anticipated in December, likely sustaining demand growth.

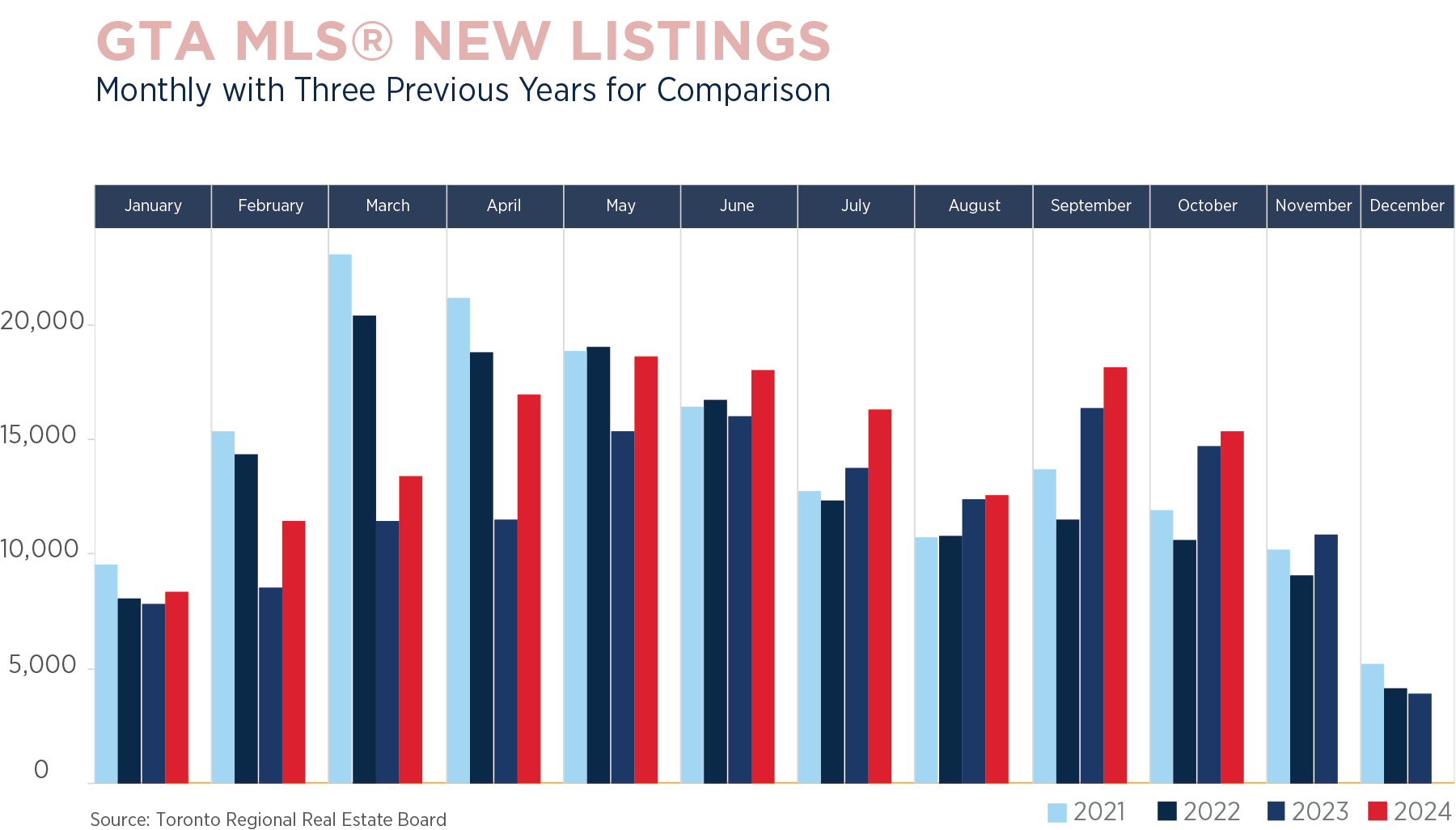

New listings increased at a slower pace, up by 4.3%. The average home price in Toronto reached approximately $1,135,215, reflecting a modest 1.1% increase from October 2023. Currently, listings in Toronto remain active on the market for an average of 27 days, indicating steady turnover and ongoing buyer interest. Although inventory levels are still relatively high, market indicators showed stable values for the second consecutive month, suggesting prices are likely to remain steady. Government actions, such as potential tax relief, could enhance affordability and positively influence homebuyer decisions.

Pre-Construction Market

Year-to-date, construction starts have declined by 73% compared to the peak two years ago. However, condo completions are on track to hit record highs this year and next. New projects totaling 2,231 units were put on hold or canceled, while 1,111 units from existing presale projects transitioned to purpose-built rentals. Condo completions in 2024 are projected to reach 24,386 units, exceeding last year’s record of 24,114.

Rental Commentary

In the condo rental market, lease transactions increased by 38% year-over-year, reaching a record high of 677 units. This was primarily driven by immigration and Toronto's population growth. However, the number of available rental listings also grew, giving renters more flexibility in terms of price and leading to a 2.4% decrease from last year's record high. Average condo rents remained relatively stable at $2.84 per square foot. This trend could continue if lower interest rates encourage more people towards homeownership.